Introduction of Tesla share Price:

Tesla Share Price : Tesla Inc. (NASDAQ: TSLA) (Tesla’s share price) is one of the most talked-about and closely watched stocks in the market. As a leader in the electric vehicle (EV) industry, Tesla’s share price has experienced significant volatility, driven by factors ranging from production milestones to CEO Elon Musk’s market-moving tweets. Understanding the key influences on Tesla’s stock can help investors make informed decisions. In this article, we will explore the historical performance, recent trends, and future projections for Tesla’s share price.

Historical Performance of Tesla’s Share Price

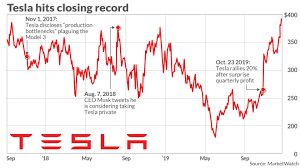

Tesla went public in June 2010 at an initial public offering (IPO) price of $17 per share. Since then, the company’s stock has seen exponential growth, often fueled by strong vehicle sales, technological advancements, and investor confidence in Elon Musk’s vision.

Key Milestones in Tesla’s Stock Price History

- 2013: Tesla’s share price surged past $100 for the first time due to growing Model S sales and profitability.

- 2017: The stock crossed the $300 mark as Tesla ramped up production for the Model 3.

- 2020: Tesla’s stock soared past $2,000 per share (pre-split), leading to a five-for-one stock split in August.

- 2021: The market capitalization of Tesla exceeded $1 trillion for the first time, putting it in the league of tech giants like Apple and Microsoft.

- 2022-2023: Tesla’s stock experienced volatility due to macroeconomic factors, supply chain issues, and increasing competition in the EV market.

- 2024-2025: Tesla has faced both gains and losses, influenced by production numbers, innovation, and CEO Elon Musk’s political stances.

Factors Influencing Tesla’s Share Price

Tesla’s stock price is influenced by multiple factors, including production and delivery numbers, financial performance, competitive landscape, and broader economic conditions.

1. Vehicle Production and Deliveries

One of the most critical factors affecting Tesla’s stock price is its ability to manufacture and deliver vehicles. Investors closely monitor Tesla’s quarterly delivery reports. In 2023, Tesla delivered approximately 1.8 million vehicles, marking a 38% increase from 2022. However, concerns over production challenges and supply chain constraints continue to impact investor sentiment.

2. Financial Performance and Earnings Reports

Tesla’s quarterly earnings reports significantly impact its stock price. Key financial metrics include:

- Revenue Growth: Tesla reported annual revenue of $97.69 billion in 2024, demonstrating steady growth.

- Profit Margins: While revenue has increased, concerns over declining margins due to price cuts and competition persist.

- Cash Flow & Debt: Tesla’s ability to manage debt and generate free cash flow plays a crucial role in stock valuation.

3. Technological Innovations and Product Pipeline

Tesla’s commitment to innovation has helped maintain its status as an industry leader. Recent advancements, such as Full Self-Driving (FSD) capabilities, battery technology improvements, and AI-driven automation, contribute to its valuation. Additionally, Tesla’s plans to launch a more affordable EV priced under $30,000 could expand its customer base and positively impact its stock price.

4. Competitive Landscape

Tesla faces increasing competition from traditional automakers like Ford and General Motors, as well as EV giants such as BYD and Rivian. The rise of Chinese EV manufacturers has put pressure on Tesla’s market share, particularly in Asia. Investors are keenly watching how Tesla navigates this competition.

5. Elon Musk’s Influence and Market Sentiment

Elon Musk’s actions and statements often cause fluctuations in Tesla’s share price. His involvement in ventures like SpaceX, Neuralink, and Twitter (now X) has raised concerns among investors about his focus on Tesla. Additionally, his political endorsements have sparked controversies, impacting Tesla’s brand perception and potential sales.

6. Macroeconomic Factors

Economic conditions, interest rate changes, inflation, and global supply chain disruptions all play a role in Tesla’s stock performance. Higher interest rates, for example, make financing vehicles more expensive, potentially dampening demand.

Recent Trends and Developments

1. Stock Price Decline in 2025

In early 2025, Tesla’s stock experienced a significant drop, falling 15.4% in one month. Analysts attribute this decline to weaker-than-expected sales figures and increased competition. Tesla’s market capitalization, which once surpassed $1.5 trillion, has now fallen to around $845 billion.

2. Tesla’s Political Controversies

Elon Musk’s endorsement of certain political figures and parties has led to a decline in Tesla’s popularity among some consumers. In Germany, Tesla registrations dropped by 76% in response to Musk’s political affiliations, raising concerns about the broader impact on sales.

3. Analyst Ratings and Forecasts

Market analysts have revised their price targets for Tesla stock. UBS, for instance, lowered its 2025 delivery forecast from 2 million to 1.7 million vehicles, reflecting concerns over demand and production. Some analysts have downgraded Tesla’s stock rating, cautioning investors about near-term volatility.

Future Projections for Tesla’s Stock Price

Despite current challenges, many analysts remain optimistic about Tesla’s long-term growth potential. Key factors that could drive future stock appreciation include:

1. Expansion into New Markets

Tesla’s efforts to expand in emerging markets like India and Southeast Asia could unlock new revenue streams. If Tesla successfully penetrates these markets with its upcoming low-cost EV, its stock price could see renewed growth.

2. Advancements in AI and Robotics

Tesla’s investments in AI, including the development of humanoid robots and self-driving technology, could create new revenue opportunities. If Tesla’s AI-driven initiatives gain traction, they could significantly impact its valuation.

3. Stock Buybacks and Investor Confidence

Tesla’s potential stock buyback programs may boost investor confidence, leading to price stabilization. Additionally, continued institutional investment in Tesla could drive further upside.

Conclusion: Should You Invest in Tesla Stock?

Tesla’s stock remains a high-risk, high-reward investment. While the company has demonstrated strong growth and innovation, factors such as competition, economic conditions, and Elon Musk’s influence add volatility. Investors should consider both short-term risks and long-term potential when deciding whether to buy, hold, or sell Tesla stock.

For those with a high-risk tolerance, Tesla may still present opportunities for growth, especially if the company successfully expands into new markets and maintains its technological leadership. However, staying informed about market trends, company developments, and broader economic conditions is essential for making well-informed investment decisions.